Project scoper overview

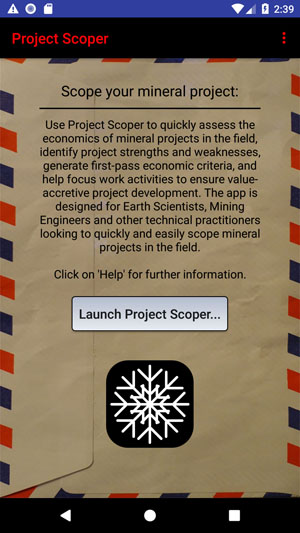

On the ProjectScoper homepage click on the 'Launch ProjectScoper...' button to commence the project assessment process.

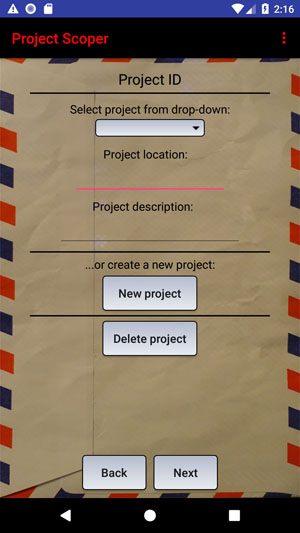

When ProjectScoper is launched for the first time no projects will exist in the database. To create your first project click on 'New project' to go to the 'enter project' screen. (Once a new project has been entered the project can be selected from the dropdown.)

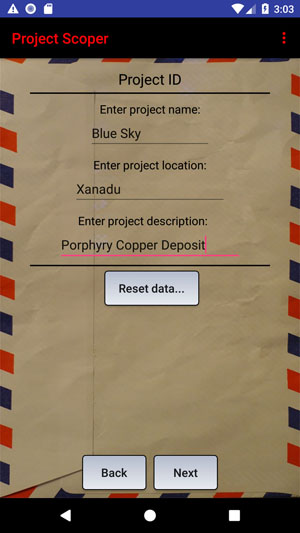

In the 'enter project' screen enter the name, location (optional) and description (optional) of the project. Press 'Next' to go to the Commodity data section of the app. Note that by pressing 'Next' the project ID data is stored permanently in the project database, and there will be no need to re-enter the data should the app be closed and re-started later.

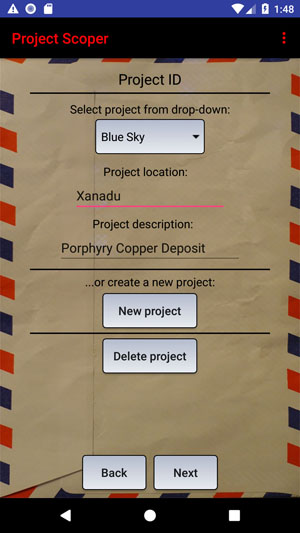

If projects have been assessed previously, these will appear in the dropdown when ProjectScoper is launched. Select the project of interest and press 'Next' to view previously entered data. The data can be changed as desired and the new data will be stored permanently in the project database.

In the Commodity data section select the metal(s) concerned - up to two may be chosen. Enter the price, grade and recoveries for the selected metal(s). The price and grade units will be displayed automatically. Recoveries are calculated by multiplying the mine recovery by the plant recovery for the metal concerned. If unknown enter 100%. Press 'Next' to go to the Exploration data section of the app. Again, all data entered will be stored permanently in the project database.

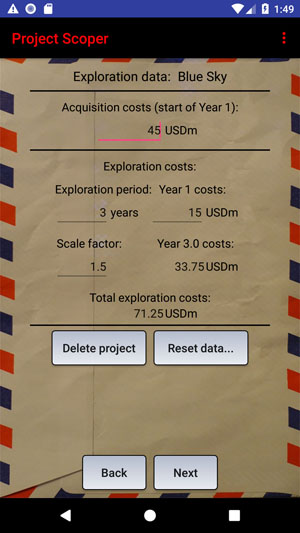

Enter the project acquisition costs, if any. Then enter the anticipated exploration costs as follows - input the remaining exploration period going forward in years (from one to five (past exploration expenditures are considered sunk)), the expected costs for the first year of exploration, followed by a scale factor to progressively increase exploration expenditures during the exploration period. A scale factor of up to five may be entered (remember to account for economic studies that will need to be completed during the exploration period - e.g. a PFS). The final year and total exploration costs will be shown automatically. Press 'Next' to go to the mine development costs section of the app.

Enter the anticipated mine development costs as directed. Enter the mine development duration in years (either one or two). Enter the 'mid-production capex', if any - e.g. capex spent transitioning from open pit to underground operations some way through the mine life, or a major push-back in the case of an open pit. Enter the amount to be spent and the year in which the funds will be expensed. ProjectScoper assumes a 10-year mine life so the 'Year' must be 10 or less. Press 'Next' to go to the production data section of the app.

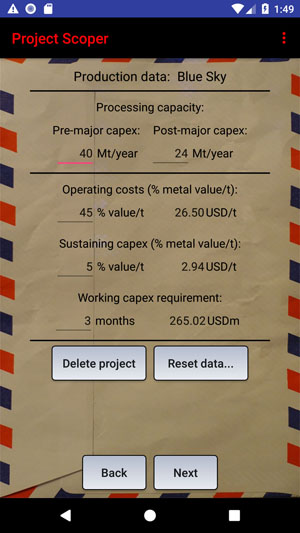

Enter how much ore is expected to be processed annually in the pre-major capex phase of the operation, and the post-major capex phase of the operation, if relevant. If there is a major capex injection midway through operations (e.g. from open pit to underground operations) there may be a significant reduction in tonnage processed after the cash injection. Enter the estimated operating costs as a percentage of the metal value per tonne of ore. 40% to 50% might be considered fairly standard although the figure chosen will be obviously be specific to the jurisdiction concerned, the availability of infrastructure, and the nature of the orebody itself. The sustaining capex is entered in a similar fashion - generally a figure of 5% or less would be applied. Finally, enter the number of months of working capital that is required (i.e. the period before income is first received). Generally, three months is considered appropriate but this may be higher (or lower) based on jurisdictional and other considerations. Press 'Next' to go to the closure/tax data section of the app.

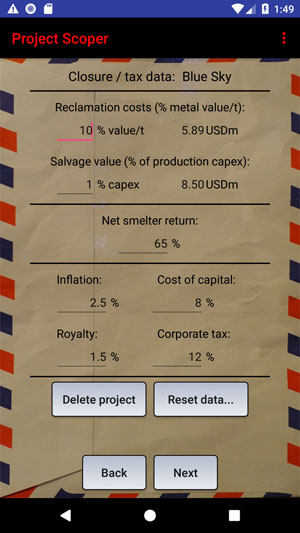

Enter the anticipated reclamation costs as a percentage of the metal value per tonne of ore, and likewise for the expected salvage value on mine closure. Enter the expected net smelter return, to account for downstream costs which are not included in the operating cost and capital expenditure estimates. Then enter the anticipated inflation rate over the 10-year default life of the project, the expected cost of capital, and the royalty and corporate tax rates. Inflation is important because depreciation allowances (app default = 100%), based on actual capital expenditures, do not inflate with time. If inflation is not taken into account, depreciation allowances are overestimated, taxable income and tax payments are underestimated, and after-tax cash flows and discounted cash flow indicators are overestimated. Press 'Next' to go to the cash flow indicators section of the app.

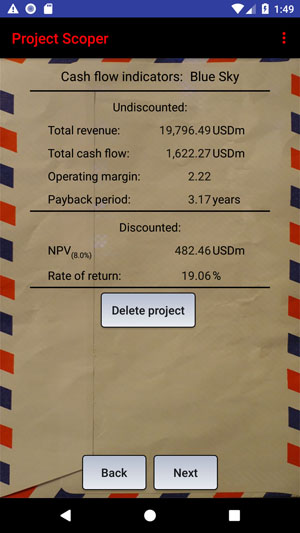

The cash flow indicators screen shows the key undiscounted and discounted criteria for the project allowing for an economic assessment of project viability to be made. It is assumed that the user understands the nature and import of economic assessment criteria as these relate to mineral projects generally. Press 'Next' to go to the cash flow components section of the app.

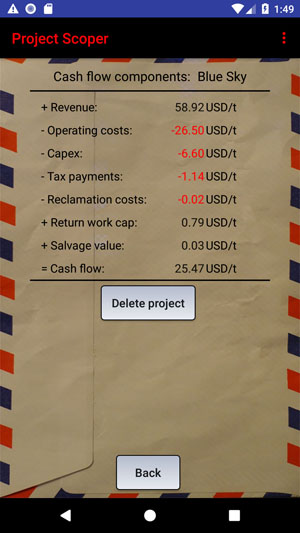

The cash flow components screen provides a breakdown of the various cash flow elements on a per tonne of ore basis, allowing the user to see how each tonne of ore contributes to the overall cash flow.